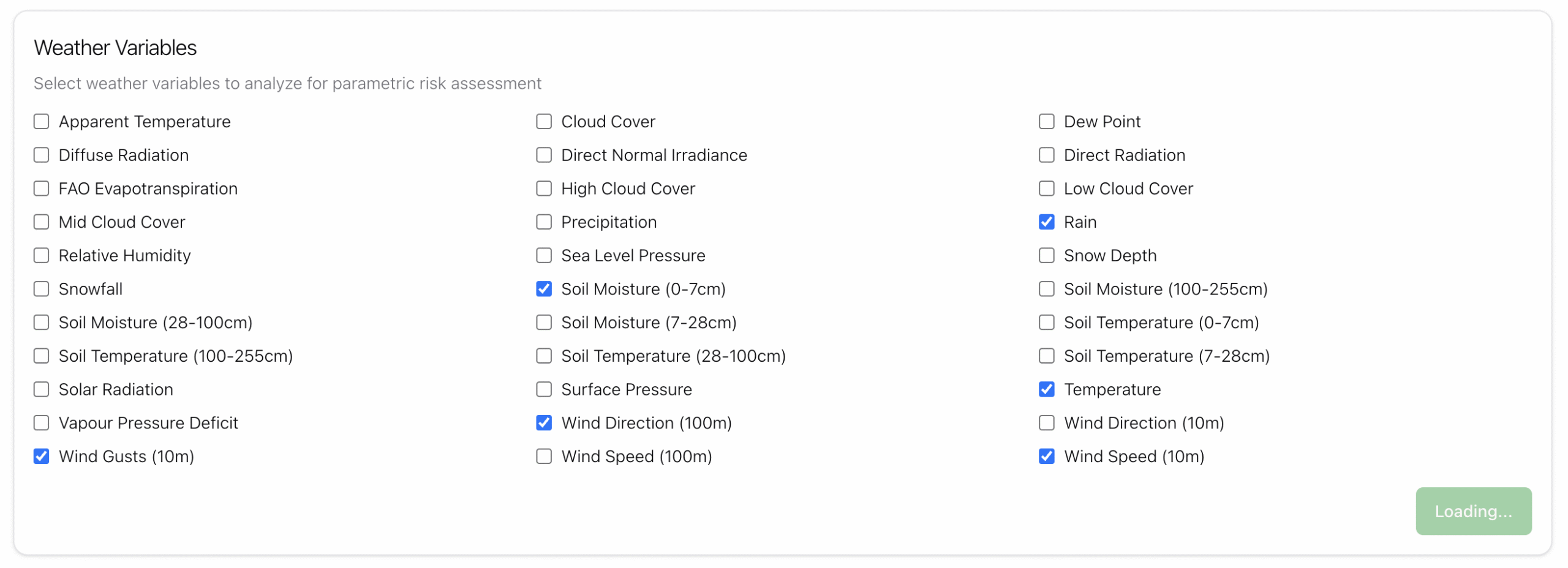

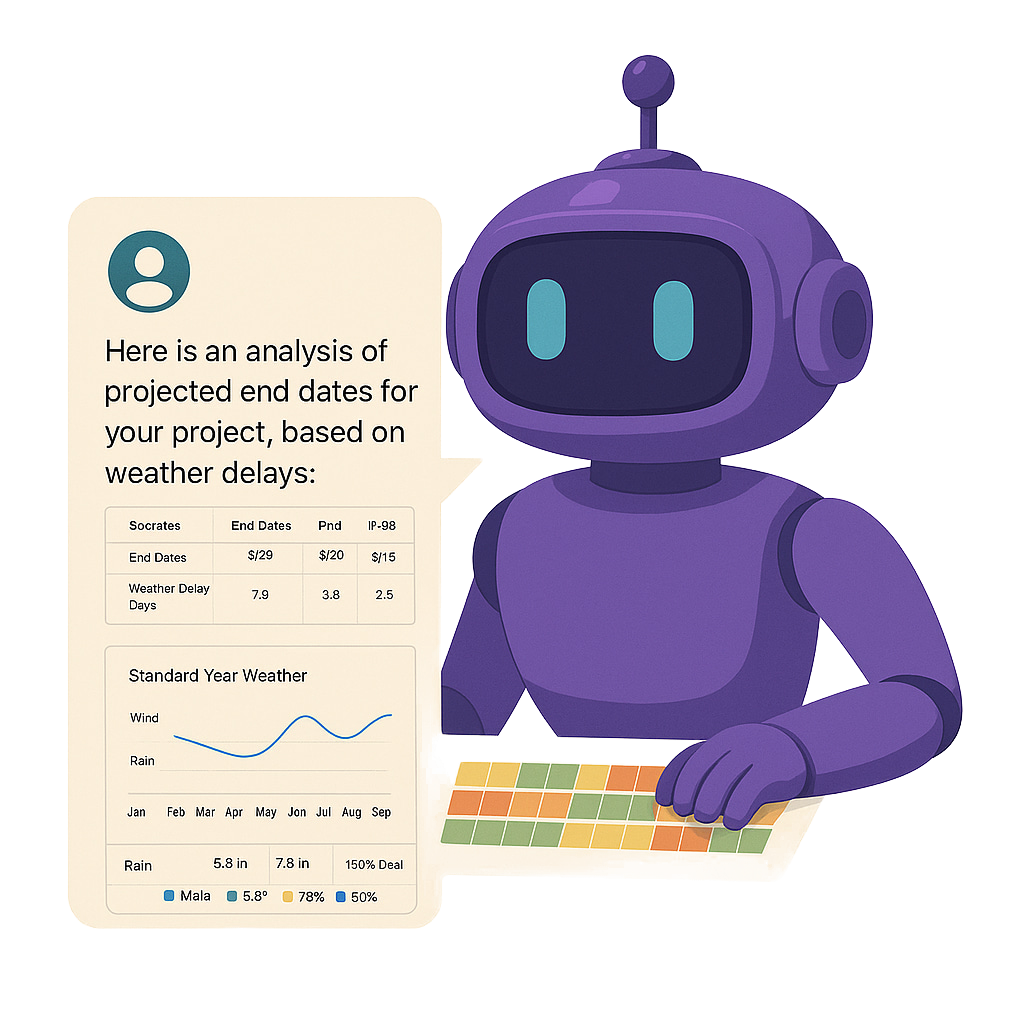

Compose custom weather signals

No need for a full team of expensive meteorologists or climatologists. Rapidly generate weather related signals for over 80 perils with ai; globally.

Get an edge with daily insights

Informed Bets

Anticipate demand shifts and market impacts with better-than-market weather insights.

Market Edge

Get ahead of competitors in weather-sensitive trades with proprietary, AI-enhanced signals.

Risk Management

Sharpen hedging strategies and exposure management using more precise, forward-looking data.

Multi-Layered Weather Data

WeatherWise Signals delivers exclusive, AI-powered weather intelligence that transforms raw atmospheric data into actionable trading signals. Covering energy, agriculture, shipping, and commodities, even small forecasting advantages can drive outsized gains — especially in weather-sensitive markets where timing and precision matter most.

By tapping into one of the most comprehensive weather data ecosystems available — including satellite observations, ground-level sensors, operational disruptions, insurance exposures, and long-term climate models — you gain access to insights most traders simply can’t see. This lets you spot risks, opportunities, and market shifts before they ripple through public data streams, giving you a decisive edge in building informed, high-confidence trades.

Collective Weather Intelligence

WeatherWise Signals goes beyond public forecasts, tapping into a proprietary global network of operational data from the broader EHAB WeatherWise suite. This includes real-world insights on price impacts, operational disruptions, and interdependencies — data you can’t get anywhere else.

Exclusive Operational Data

WeatherWise taps into proprietary business-level data from global users — revealing how weather impacts pricing, supply chains, and operations in ways public datasets simply can’t match.

Continuous Learning AI

Our AI engine doesn’t stand still. It continuously refines signals by learning from new data, user interactions, and real-world outcomes — ensuring your insights stay ahead of market shifts.

Stronger With Every User

The more companies use the WeatherWise ecosystem, the more powerful the signals become. Every data point strengthens the network, delivering compounding value across all connected users.

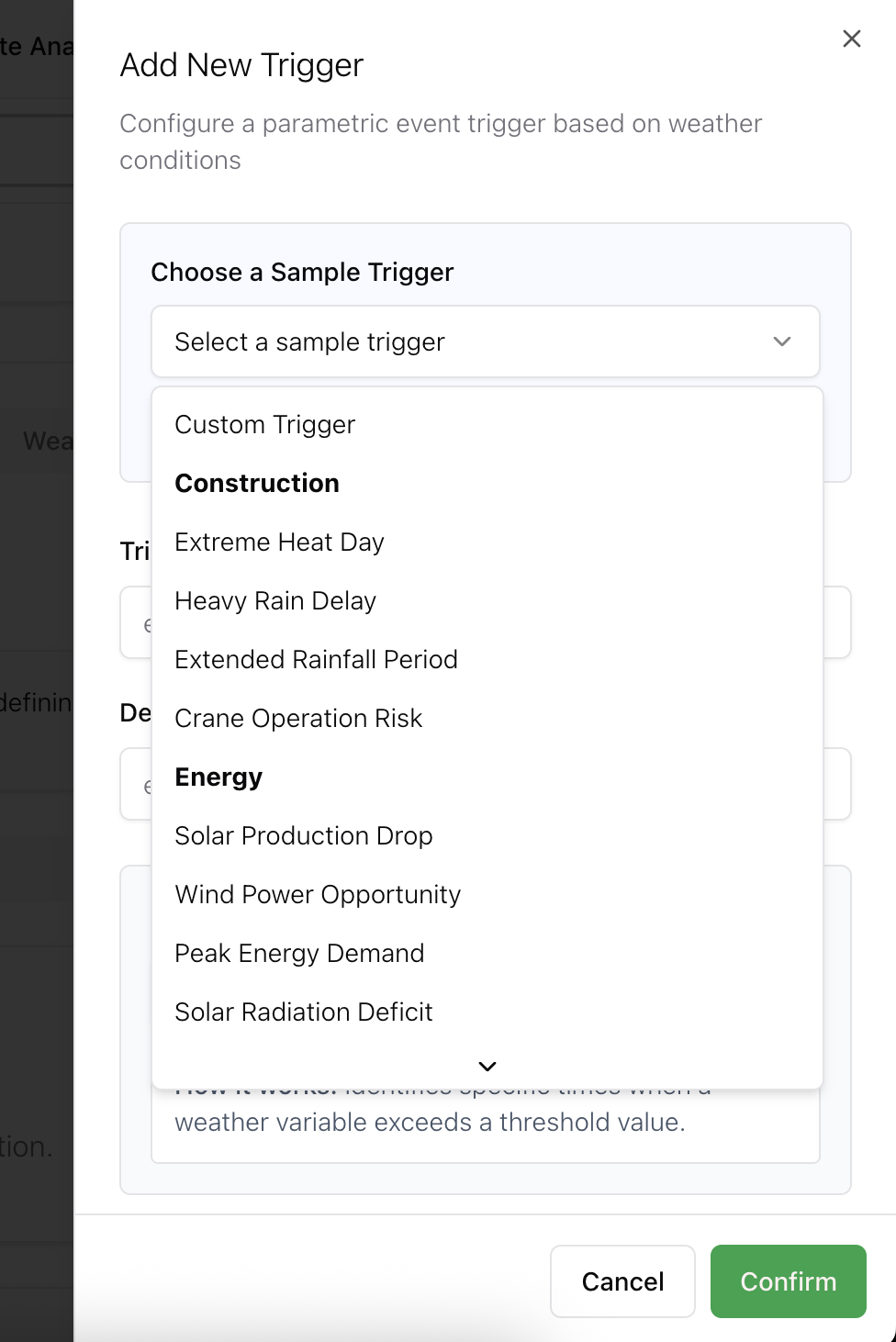

Rapidly create bespoke signals

Add your locations

Describe in natural language the areas the signal should include

Input risk thresholds

Tell the ai what weather types will influence this asset and the impact

Confirm structure

Setup simple warnings for a breach or more advanced warnings for percentage differences

See what our users are saying

Rated 4.9/5 from over 100 reviews

"I can't believe how much time I've saved since using this AI email generator. It's a game-changer for efficiency. Professional emails has now easier. Highly recommended!"

William Franky

BusinessmanRated 4.9/5 from over 100 reviews

"Impressed with the productivity boost! The AI email generator has significantly reduced my email drafting time and allowing me to focus on more strategic tasks. A must-have for anyone looking to optimize their workflow."

Jones Jacob

HR @ XYZ CompanyRated 4.9/5 from over 100 reviews

"The 80% faster response rate is no exaggeration. Our clients are appreciate the quick turnaround, and it has positively impacted our relationships."

Adam Smith

Head of Marketing

Frequently asked questions about it

What types of weather signals can I access with WeatherWise Signals?

We provide proprietary signals covering energy demand, agricultural yields, shipping delays, commodity supply disruptions, and climate-driven volatility — all tailored for financial markets.

How are WeatherWise Signals different from public weather data?

Our signals combine real operational data, insurance exposures, and advanced AI modeling — delivering predictive insights far beyond basic public forecasts or raw weather feeds.

How can weather signals improve my trading strategies?

Weather-sensitive markets like natural gas, power, agriculture, and metals are highly reactive to forecast shifts. Even marginal improvements in timing or accuracy can unlock significant alpha and improve risk-adjusted returns.

Can I integrate WeatherWise Signals into my quant-models or dashboards?

Yes — we offer seamless API access, allowing you to plug WeatherWise Signals directly into your proprietary models, trading systems, or analytics dashboards. COMING SOON! Get in touch if this is a requirement blocking usage.

Who uses WeatherWise Signals today?

Our signals support hedge funds, commodity traders, asset managers, and insurers who want a competitive edge in weather-sensitive markets — without needing an in-house weather science team.

Transform your trading, get your data pack today!

Weather uncertainty is impacting your performance. Get ahead with best in class, ai driven, weather signals.