Accelerate parametric,

unlock resilient risk transfer

WeatherWise Broker helps you accurately and rapidly quote parametric cover to your clients, no matter where they are, or how sophisticated.

Rapid quoting

Get indicative quotes in minutes rather than weeks. Close deals with happier clients.

Extra capacity

Work directly with carriers through the platform. Source more for your clients.

AI enhanced

Leverage our AI bot to structure policies from templates or go completely bespoke.

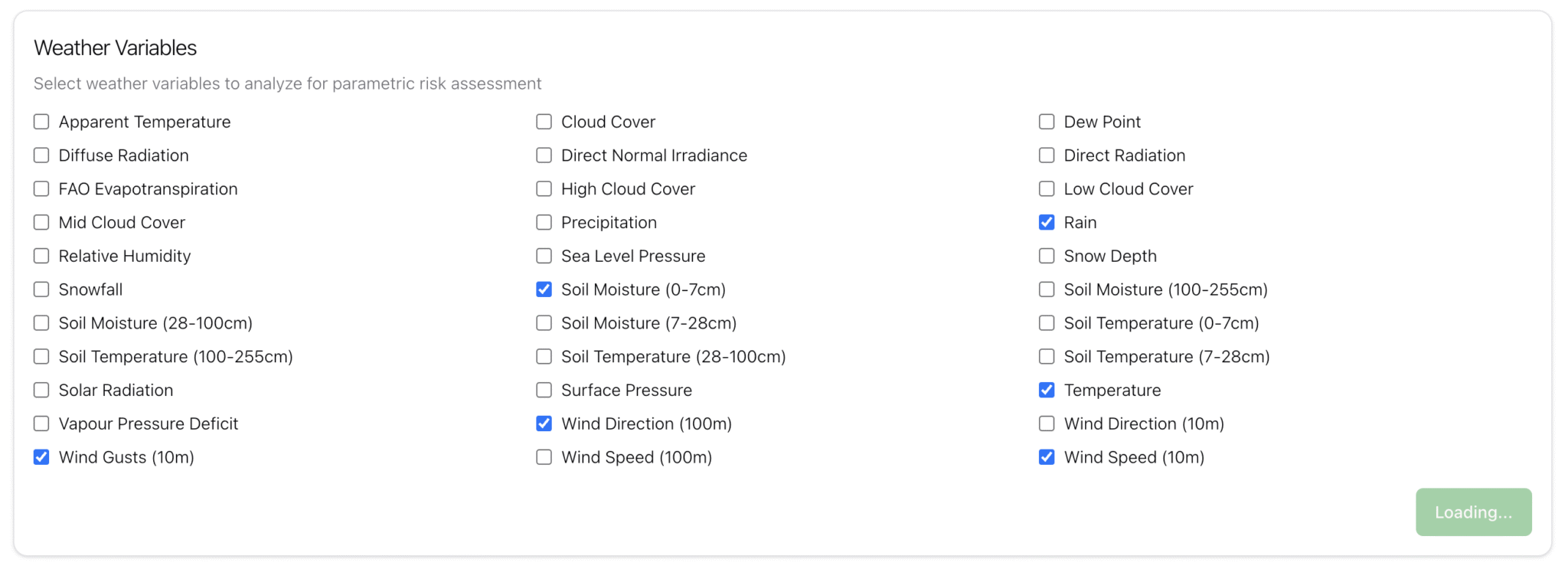

80 variables

Choose from a wide range of variables. Wind, rain and temperature, but also soil moisture and solar radiation.

Data is accessible globally and with so many variables at your finger tips you can rapidly assess and quote whatever the peril, whatever the location.

Custom & templated policies

Choose from a set of standard and commonly used tempate policies. Or go completely bespoke. With the platform you can generate something unique for your client in minutes rather than weeks.

- Powerful templates to get you started

- Easy to use form for bespoke policies

- Chat with our ai meteorologist to structure

A solution to help brokers

Win More Business

Differentiate with clear, data-backed weather risk insights that close new business.

Boost Revenue

Add parametric and weather-linked policies to grow your premium base.

Instant Quotes

Access embedded carrier capacity, generate rapid quotes, speed up placement.

Strengthen Client Retention

Provide ongoing monitoring and reporting that keeps clients engaged.

Work Smarter with AI

Let AI handle analysis and recommendations, saving time and effort.

Enhance Cover

Carve out weather exposures from traditional policies with parametric to reduce deductibles.

Parametric Insurance | Quick Quotes | Rapid Risk Management | Leverage AI |

Next evolution of resilient risk transfer

Create a free account

Every broker can get started for free.

Enter a location

Drop a pin anywhere on planet earth.

Identify risk

Show your client on the call the level of exposure and get indicative pricing all with a few clicks.

Get started today

A simple platform built to help brokers access weather parametric quickly and easily.

FAQs

What is parametric insurance and how does it apply to weather risk?

Parametric insurance pays out based on predefined weather triggers like windspeed, rainfall, or temperature. It’s ideal for industries such as construction, maritime, agriculture, and logistics, where fast, transparent claims are crucial. EHAB’s WeatherWise Broker helps you design and place these covers with precision.

How can brokers access reliable weather risk data for their clients?

Brokers often face challenges sourcing credible weather data. WeatherWise Broker, powered by EHAB, provides high-resolution weather risk insights across multiple industries, helping you confidently assess exposures and support risk transfer strategies.

How can I accelerate weather insurance quoting for my clients?

With embedded carrier capacity, WeatherWise Broker delivers near-instant quotes for parametric policies. This rapid quoting process reduces turnaround times across construction, maritime, agriculture, and other weather-sensitive sectors.

Why carve out weather risk from traditional insurance policies?

Separating weather risk into parametric solutions reduces claims disputes and creates smarter deductible structures. EHAB’s WeatherWise Broker makes it simple to identify these opportunities and craft tailored risk transfer strategies.

How does AI make weather risk broking more efficient?

WeatherWise AI automates exposure mapping, trigger analysis, and policy recommendations, allowing brokers to focus on client relationships and growth rather than manual data work.

Can I monitor live weather exposures for my clients?

Yes. WeatherWise Broker offers real-time monitoring of client assets and locations, alerting you when weather thresholds are met, so you can keep clients informed and manage exposures proactively.

How does EHAB support brokers in securing placements?

EHAB’s platform delivers robust, insurer-ready reports and parametric structures that improve placement success across global insurance markets — helping brokers win better terms and faster approvals.

What they say

"The EHAB platform and this upcoming AI enhanced product, offer powerful tools for helping contractors and insurers better understand, evaluate, and manage risk—while also enabling brokers to deliver compelling parametric insurance solutions."

Julian Wood

Miller Insurance"We’re partnering with EHAB to help construction clients build resilience against extreme weather. This collaboration gives them powerful insights and tools to manage growing climate risks.”

Patrick Bravery

Global Head of Civil Construction, Liberty Specialty Markets“Our integration with EHAB lets customers combine real weather data with project risk models—tackling a key challenge: improving the quality of weather data in risk analysis.”